tax brackets australia

Tax owed at this tax bracket. This was further modified by Budget 2020 announcements to lift the 19 rate ceiling from 37000 to 45000 and the 325 tax bracket ceiling from 90000 to 120000.

|

| Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute |

Go to Seasonal Worker Programme and Pacific Labour Scheme for withholding rates for individuals employed under those schemes.

. Income taxable at 325. 325 Taxable income band AUD. The tax-free threshold is 18200 so if you earn anything below that you wont be required to pay income tax. State governments have not imposed income taxes since World.

Despite media speculation the budget has also retained the already legislated Stage 3 tax cuts. Equally the Budget did not announce changes to the Stage 3 tax cuts which are set to commence from 1 July 2024. You can find our most popular tax rates and codes listed here or refine your search options below. But this is where people get confused.

Tax brackets in Australia are set by the Federal Government and the Australian Tax Office ATO. 19 Taxable income band AUD. Under these changes the 37 tax bracket will be. They determine the rate of tax that each Australian taxpayer pays based on their annual.

90001 to 180000 National income tax rates. On top of this sum you have to pay a 2 Medicare Levy. National income tax rates. The standard deduction for single taxpayers.

The 325 tax bracket ceiling lifted from 90000 to 120000. 37001 to 90000 National income tax rates. The Australian Tax Office ATO provides employers with a range of tax deduction tables to make PAYG withholding simple. 19 cents for each 1 over 18200.

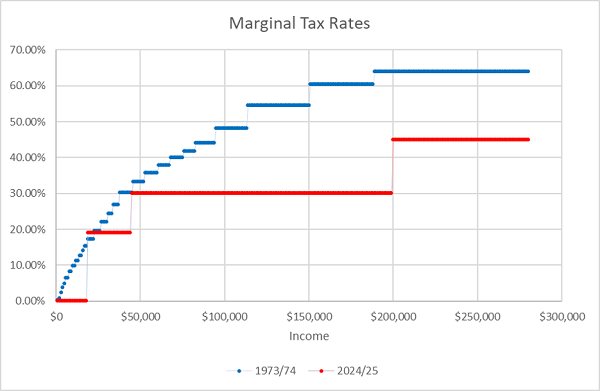

The Australian income tax brackets start at 18201. Each income threshold pays a higher tax percentage on the. The individual income tax rate in Australia is progressive and ranges from 0 to 45 depending on your income for residents while it ranges from 325 to 45 for non-residents. Standard Deduction Raised.

Many believe that when you earn enough money to enter a new tax bracket you will pay a higher rate of tax on all your income. For a taxpayer with taxable income of exactly 120000 the. Moreover if you earn above 90001 you will have to pay an. When you submit your tax return ATO will calculate your tax bracket for you.

From July 1 2024 the 37 per cent tax bracket will be removed and the 325. 5092 plus 325 cents for each 1 over. Income taxable at 19. Income tax in Australia is imposed by the federal government on the taxable income of individuals and corporations.

Tax rates and codes. 19 hours agoThe modelling also showed that the stage three tax cuts would decrease personal income tax revenue by 183 billion in 2024-25 while childcare subsidies will add 15 billion to. You will also find a handy calculator that will calculate the correct. 90000 37001 52999.

Make sure you click the apply filter or search button after entering your. Tax owed at this tax bracket. 5 rows For Australian residents the tax-free threshold is currently 18200 meaning the first 18200. The 19 rate ceiling lifted from 37000 to 45000.

Go to PALM scheme workers for withholding rates. 37000 18201 18799. Your tax bracket consists of your total earnings after tax deductions. Otherwise the tax bracket you fall into will depend on how much.

Revenue Procedure 2022-38 also stated that among tax deduction and exemption changes for 2023.

|

| At A Glance Treasury Gov Au |

|

| Nz Taxpayers Getting Off Lightly Oecd Data Suggests Stuff Co Nz |

|

| Fact File How Much Extra Tax Are Australians Expected To Pay Because Of Bracket Creep Abc News |

|

| 2020 21 Federal Budget Details What S In It For You |

|

| Tax Rate Changes Starting Now Initiative Chartered Accountants Financial Advisers |

Posting Komentar untuk "tax brackets australia"